What is in the model portfolio?

A dynamic best 10 stock model portfolio chosen from the S&P 100 universe. The model universe excludes IPO’s and Cap Raising. Bear market ETF may be used as a stock pick in certain parts of the cycle to manage high-risk macro/market outlook. Cash holding in the model can vary from 0% to 50% depending on the macro/market risk outlook.

Investment strategy?

Vertically integrated data-driven structured investment process to deliver risk-managed outperformance within the model portfolio parameters.

What are the investment expectations?

Sustainable long-term above-market performance with managed volatility and downside protection.

Why this model portfolio?

- Moderate diversification potential

- High-risk management

- Low turnover

- High liquid holdings

- Better than market returns over the long term

- Benchmark S&P 200

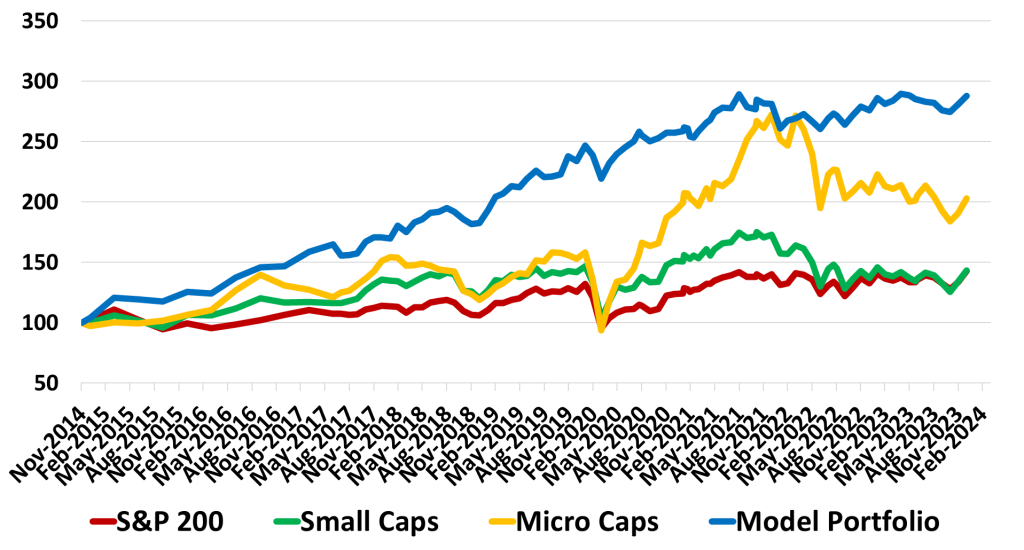

Historical model performance

Performance analysis excludes dividends and transaction costs.